Last Updated on: May 14, 2024

Reviewed by Kyle Wilson

Thinking about securing a $10 million life insurance policy but worried about 10 million dollar life insurance policy cost? You’re not alone. The price tag on a policy this size can seem daunting, but understanding the factors that influence the cost can help you navigate the decision more confidently. Let’s break down what goes into determining the premiums for a life insurance policy of this magnitude.

Customized Options Await

A $10 million life insurance policy is a high-value insurance coverage designed to provide substantial financial security. This type of policy is typically considered by individuals who have significant financial responsibilities or large estates. The benefits can help cover estate taxes, sustain a business’s operations, or maintain a family’s lifestyle after the policyholder’s death.

If you’re eyeing lifestyle coverage with a hefty $10 million payout, you’re, in all likelihood, someone with good-sized belongings or responsibilities that you need to steady for the future. Here’s a better look at what varieties of rules can provide this kind of payout, what you would expect to pay, and the way you could move approximately getting one.

This is pretty straight-up. You pick a duration, say 10 or twenty years, and if you bypass away at some point of this time, your beneficiaries get the $10 million. It’s usually greater wallet-pleasant compared to permanent options.

This one’s for keeps. You’re covered for life, and part of what you pay builds up as cash value, which you can tap into later. Also, consider $10 million dollar whole life insurance policy cost before buying.

Here, you get some wiggle room. You can tweak your premiums and the payout amount. It also builds cash value, which is tied to an interest rate.

A bit like universal life but with a twist—you can invest the cash value in things like mutual funds. The value can go up or down based on how these investments perform.

It’s not one-size-fits-all: Costs can vary wildly depending on your age, health, lifestyle, and even the type of policy you choose.

Gender plays a role, too. Typically, women might pay a bit less than men because they usually live longer.

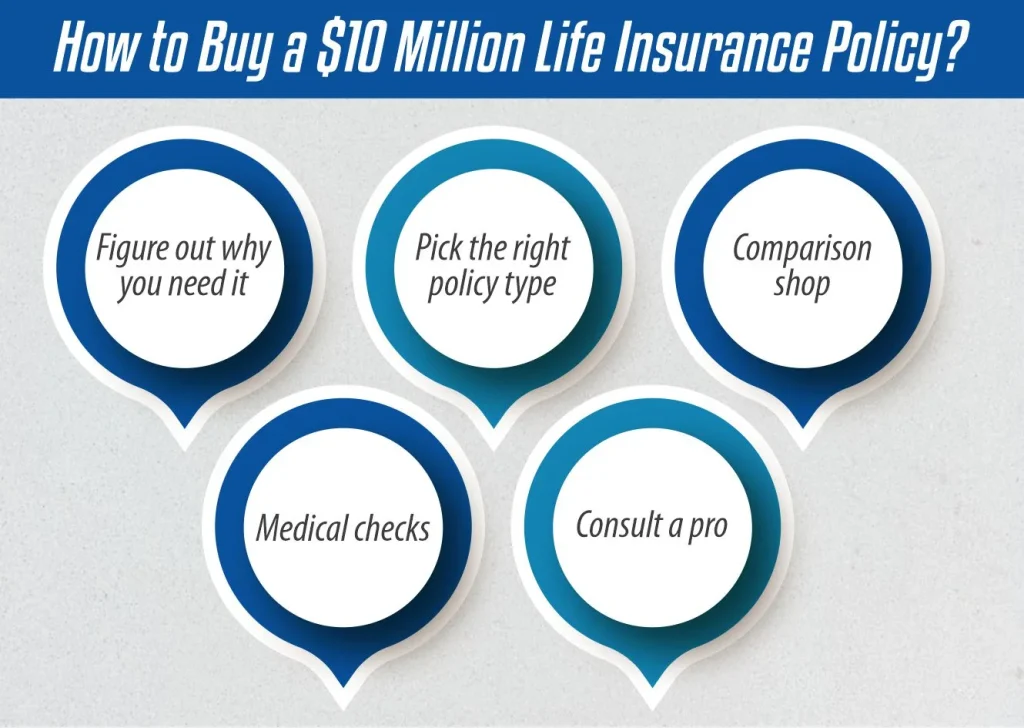

Are you looking to protect your family’s lifestyle, cover business debts, or manage estate taxes? Knowing your why will guide your what.

Reflect on whether a term or permanent policy matches your long-term financial plans.

Don’t settle on the first quote. Prices and terms can vary a lot between insurers.

Be prepared for a thorough health assessment. For such a large policy, insurers will want to know your medical history in detail.

Given the stakes, talking to a financial advisor or an insurance broker can help you make the right decision.

Securing a $10 million life insurance policy is a prime move. It’s about more than just the numbers; it’s about peace of mind and understanding that whatever happens, the belongings you care deeply about can be sorted. Make sure to dive deep into How much does 10 million dollar life insurance policy cost. Comprehend your options, and select a plan that aligns flawlessly with your needs and goals.

Buying a 10 million dollar life insurance policy isn’t a choice. It’s a significant choice for people with large property or duties. Here’s what you need to recognize approximately the requirements and motives for securing this type of policy.

Requirements for Buying a 10 million dollar life insurance policy:

Securing a 10 million dollar life insurance policy is ready extra than just the premiums—it’s approximately securing peace of thoughts and a solid destiny. Whether it is protecting your circle of relatives’s lifestyle, making sure the toughness of your commercial enterprise, or managing your property correctly, such coverage may be a cornerstone of sophisticated financial planning. With cautious attention and the proper steerage, it could function as a powerful tool in your monetary arsenal.

Deciding if a 10 million dollar life insurance policy is proper for you and knowing how factors like Gender can affect the value are important steps in making an informed coverage choice. Here’s a comprehensive appearance to help guide your choice.

The price of life coverage varies notably between genders, in most cases, because of differences in existence expectancy and fitness elements. Here’s how Gender performs a position:

A 10 million dollar life insurance policy represents a giant funding in your and your own family’s future. It’s essential to weigh the need and impact of this type of coverage towards its charges and blessings. Considerations like your economic duties, the choice to go away a huge legacy, and your cutting-edge financial fitness are key.

Additionally, understanding how factors like Gender affect the cost of lifestyle insurance will let you navigate the buying procedure more efficiently. By aligning this major financial decision with your overall lifestyle and financial dreams, you ensure that a $10 million coverage is not only a possible choice but also a prudent one.

Yes, medical exams are typically required for $10 million life insurance policies. Here’s why and what you can expect:

Navigating the prices of a 10 million dollar life insurance policy can seem complex, but it boils all the way down to your details and the type of coverage you pick out. By informing how elements like your age, fitness, and lifestyle impact premiums, you can make a properly informed choice that aligns with your monetary goals and offers peace of mind. Are you prepared to take the subsequent step and find out exactly what a $10 million coverage might cost you?

Here is our expert author, Kyle, your go-to source for simplified insights into the world of life insurance. With years of industry experience, Kyle delivers concise and approachable content, ensuring you navigate the complexities with confidence.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2024. All Right Reserved.

Get Free Life Insurance Quotes