Last Updated on: May 24, 2024

Reviewed by Kyle Wilson

Did you know that many places have special programs to make sure everyone gets a respectful goodbye, no matter their financial situation? These are called state regulated burial program, and they’re designed to help families during one of the toughest times, ensuring that their loved ones are honoured with dignity. But what exactly is a state regulated burial program, and how can it support families in need?

This thoughtful initiative not only reflects a community’s compassion but also underscores the importance of accessible farewell ceremonies for all. Let’s explore the benefits and details of these programs, so we can better understand how they provide a helping hand, making sure every farewell is marked with respect and care.

Customized Options Await

Some times Governments introduces some programs to help low income families like “state regulated burial” to make sure that the families who do not have money so they can easily pay for funerals give their family member or lovely person respectable burial ,

These initiatives value giving to everyone, regardless of financial situation. Usually, they help by paying for the basic funeral arrangements, which might include a burial site, a basic casket or cremation urn, and a funeral director’s services.

States can vary in their specific criteria for eligibility, the types of services they offer, and the application procedure for these programs. They are usually meant for low-income families, those receiving specific government subsidies, or people who are unable to cover funeral costs. The intention is to ensure that each person is handled with respect in death while easing the financial burden on families grieving.

State-regulated burial programs are a testament to a society’s compassion and respect for life, offering solace and support to those in need. By providing a framework for assistance, these programs help to ensure that the process of saying goodbye to a loved one is not overshadowed by financial concerns, allowing families to focus on healing and remembrance.

When these advertisements use the words “state regulated burial program,,” it’s just a play on words.

All insurance is governed at the state level. When an insurance company wants to offer an insurance product in your state, it must get prior approval from your state’s Department of Insurance.

The insurance company must provide the DOI with the rates, application, and a host of other financial information on the product. Ultimately, the Department of Insurance will approve the product once its requirements have been satisfied.

That is the rationale they employ to justify using the words “state regulated.” It’s technically not a lie.

However, it’s incredibly misleading to make people think that some government body in your state is managing this program and “regulating” it. Nobody at any government level knows anything about this “offer.”

Families can get a great deal of comfort and assistance during a trying time by selecting a state regulated burial program. A program like this should be chosen primarily for its financial support, which may be a lifesaver for people unable to pay the unexpected and frequently high costs of funerals and burials. The concept of respect and dignity for every person is upheld by this assistance, which guarantees that everyone has access to honourable end-of-life treatment, regardless of their financial circumstances.

Furthermore, the assurance that funeral costs will be paid for helps alleviate a great deal of the tension experienced by bereaved families. It frees them from having to worry about money so they can concentrate on honouring and grieving the life of their loved one. State-mandated funeral plans demonstrate a society’s dedication to its citizens by providing a helpful and understanding network of support that recognizes the commonality of bereavement and the need of a dignified send-off.

Whether a state regulated burial program is the best way to cover final expenses largely depends on individual circumstances, including financial situation, personal preferences, and eligibility for the program. Here are some factors to consider:

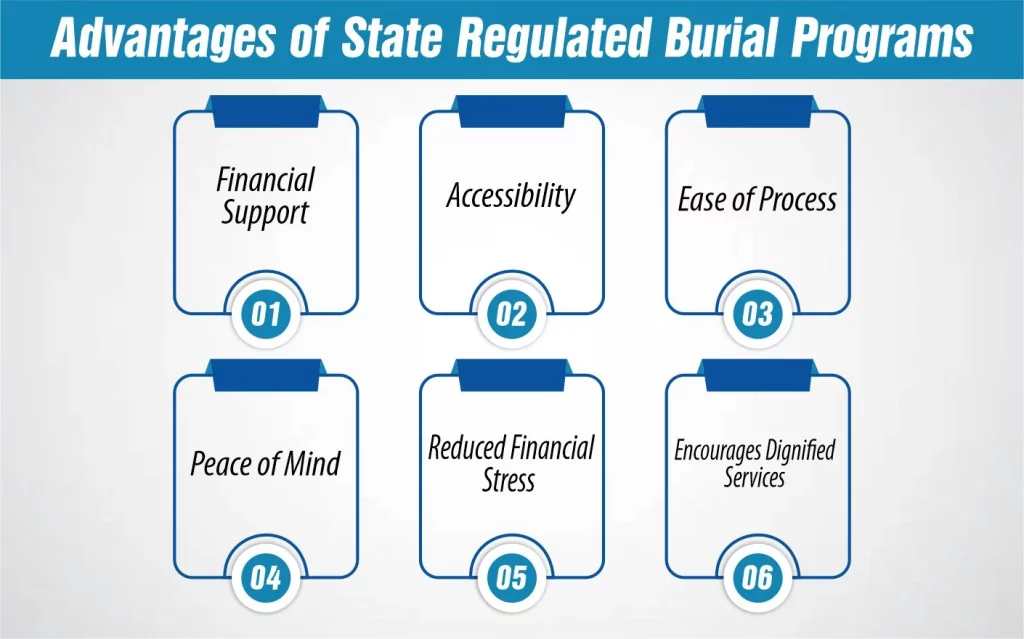

State regulated burial programs provide several important advantages, especially for individuals and families facing financial difficulties or those without the means to afford private funeral services. Here are some key benefits:

State regulated burial programs play a crucial role in providing support and dignity to those who might otherwise struggle to afford funeral services, demonstrating a community’s compassion and respect for its members in all stages of life, including death.

While state-regulated burial programs offer significant advantages, there are also some limitations and considerations to keep in mind.

These programs typically cover only basic funeral expenses. Costs for additional services, upgrades, or more elaborate memorials may not be included, which could limit personalization options for the family.

Not everyone qualifies for these programs. Eligibility is often based on financial need, residency, and other criteria, which might exclude some individuals or families in need of assistance.

The extent of services covered and the amount of financial assistance provided can vary significantly from one state to another, affecting the uniformity of support available.

The application process for these programs can sometimes be time-consuming, leading to delays. During a period of grief, any additional waiting time can be particularly stressful for families.

Not all funeral homes may participate in state-regulated burial programs, which could limit the choices available to families for funeral services and locations.

Yes, in the United States, life insurance is regulated at the state level, but the term “state-regulated life insurance” might be a bit misleading if it suggests a specific type of life insurance provided directly by the state. Instead, what it means is that all life insurance companies and the policies they offer are subject to regulation by state insurance departments.

These regulations are designed to protect consumers by ensuring that insurance companies remain solvent, operate fairly, and deliver the benefits promised in their policies.

State regulation plays a crucial role in the oversight of burial insurance, ensuring that these policies offer reliable, fair, and financially sound options for consumers planning for end-of-life expenses. Every state in the U.S. has an insurance department responsible for monitoring the insurance industry, including burial insurance policies. These departments set standards and regulations that insurance companies must follow to protect policyholders.

This includes licensing insurers, approving policy terms before they are offered to consumers, and ensuring that companies maintain sufficient financial reserves to pay out claims. State regulators also investigate consumer complaints and enforce laws against fraudulent or unethical practices. Moreover, state guarantee associations provide an additional layer of protection, offering coverage up to certain limits if an insurance company fails.

Through these regulatory efforts, states help create a stable, trustworthy environment for purchasing burial insurance, giving individuals peace of mind that their final expenses will be covered without burdening their loved ones.

In conclusion, state regulated burial programs represent a vital safety net, ensuring that individuals facing financial hardship can still provide their loved ones with a dignified farewell. These programs reflect a compassionate approach by society, recognizing the importance of accessible and respectful end-of-life services for all, regardless of economic status.

While they come with certain limitations and eligibility criteria, the benefits they offer in providing financial relief and peace of mind during a difficult time are immeasurable. By offering support for basic funeral expenses, state-regulated burial programs underscore the fundamental belief in dignity for every person in life and death. As we navigate the challenges of loss and remembrance, the existence of such programs is a reassuring reminder of the collective support and empathy that communities can offer to each other in times of need.

Burial insurance typically covers funeral costs and may also assist in settling any remaining debts.

Yes, there are various affordable options available, tailored to fit different budgets.

Most plans are accessible to seniors regardless of age or health conditions, with many not requiring a medical exam.

Here is our expert author, Kyle, your go-to source for simplified insights into the world of life insurance. With years of industry experience, Kyle delivers concise and approachable content, ensuring you navigate the complexities with confidence.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2024. All Right Reserved.

Get Free Life Insurance Quotes