Last Updated on: May 18, 2024

Reviewed by Kyle Wilson

Suppose you have ways to ensure that your final farewell will be as smooth and trouble-free as possible for your loved ones. In that case, Transfer ownership of a life insurance policy to a funeral home can be an ideal way to execute this thoughtful concept. It could be an easy way of covering funerary expenses without causing more stress to family members on such a heavy day.

But how would the whole process occur, and what are its advantages? Let’s dive into the simplicity and peace of mind that can come from making this smart financial move.

Customized Options Await

Understanding the journey that the transfer of life insurance ownership takes is key in estate management to ensure your end-of-life wishes are kept. This, in essence, allows the policy holder to change to someone else or something else, such as a funeral home. This basically causes the death benefit proceeds to pay directly for the funeral expenses and, in turn, gives a simplified means of covering the cost of one’s demise.

This is very carefully gauged since one lets go of policy control, and changing the beneficiaries or policy terms in the future is impossible. With a decision like this being permanently made, it indeed behooves someone to fully understand all its implications—taxes and everything that goes along with them—to work at length with professionals who can ensure that the strategy works seamlessly with their larger financial and estate planning goals.

When someone get the services of funeral home insurance policy , its means that it has taken on all responsibilities by its self , Whenever some ones die so its all benifits goes to family & carefully allocated to funeral and burial costs, the process is streamlined and the bereaved family’s financial and administrative burden is reduced.

Following the completion of the transfer, the funeral home manages the claim procedure in the event of the policyholder’s passing. The proceeds are used to pay for the prearranged funeral costs, with any remaining cash usually being given back to the estate or preferred beneficiary of the dead.

This approach not only facilitates a smoother execution of final wishes but also necessitates careful consideration due to its irreversible nature and the potential impact on the policyholder’s financial planning and estate distribution.

The process of Transfer ownership of life insurance policy to funeral home can be a thoughtful strategy for several reasons:

Start by researching and selecting a reputable funeral home that aligns with your preferences and is experienced in handling insurance payments.

Have a detailed conversation with the funeral home about your funeral wishes and the specifics of your life insurance policy.

Contact your life insurance company to inform them of your decision to transfer policy ownership to the funeral home.

Complete the necessary ownership transfer forms provided by your insurance company, requiring information about the policy and current and new owners.

You might need to provide additional documents, such as an agreement from the funeral home to accept ownership of the policy.

Wait for confirmation from your insurance provider that the transfer has been successfully processed, ensuring your funeral expenses will be directly covered

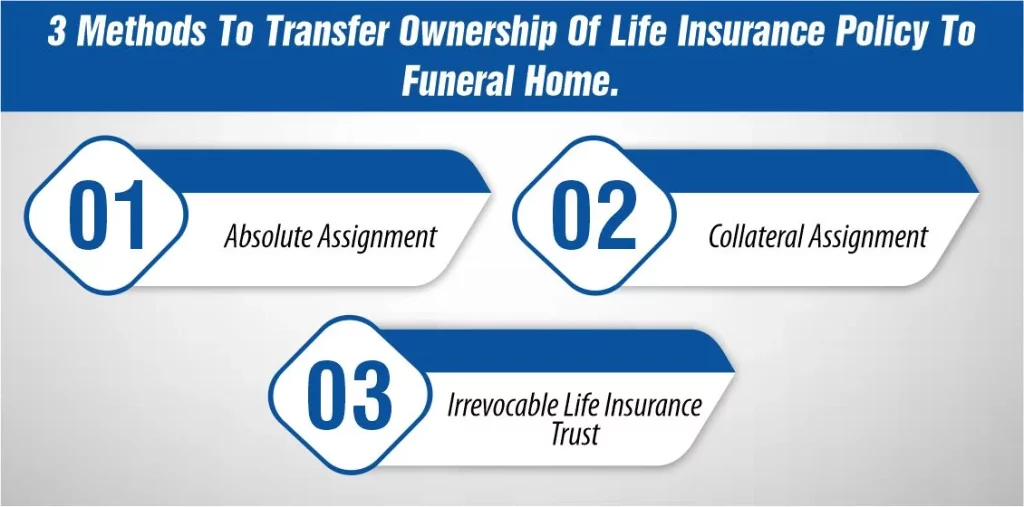

Transferring ownership of life insurance policy to funeral home can be done through several methods, each with unique features and implications. Here’s a detailed look at three such methods: Absolute Assignment, Collateral Assignment, and using an Irrevocable Life Insurance Trust (ILIT).

Absolute Assignment is a definitive method where the policyholder transfers all rights and ownership of their life insurance policy to a funeral home. This permanent change means the funeral home becomes the new policy owner, with full control over the policy, including the beneficiary designations. It’s an irrevocable decision, ensuring that the policy benefits will directly cover the funeral expenses. This method is straightforward and leaves no ambiguity about the use of the policy’s proceeds, making it a popular choice for those wanting to settle their funeral arrangements in advance.

Collateral Assignment is a more flexible approach, where the life insurance policy is assigned to the funeral home as collateral for the service costs. This Assignment is temporary and specifically linked to the amount due for funeral expenses. Once the policy’s death benefit covers the funeral home’s costs, any remaining amount is paid to the policy’s original beneficiaries. This method allows the policyholder to use their policy to guarantee funeral expenses will be covered without relinquishing total control over the policy or its full benefits.

Using an Irrevocable Life Insurance Trust (ILIT) to handle life insurance and funeral expenses offer a sophisticated estate planning tool. By placing the life insurance policy within an ILIT, the policyholder relinquishes ownership to the trust, which is managed by a trustee. Upon the policyholder’s death, the trust uses the policy proceeds to pay for funeral expenses, as directed by the trust’s terms, with any excess proceeds distributed to the trust’s beneficiaries. This method not only ensures funeral expenses are covered but also offers potential estate tax benefits and keeps the policy proceeds out of the taxable estate.

Here is the detail of how long it takes for transfer ownership of life insurance policy to funeral home.

Choosing to Transfer ownership of life insurance policy to funeral home is a thoughtful and strategic decision that ensures your final arrangements are handled according to your wishes, alleviating the financial and administrative burden on your loved ones during a difficult time.

Whether you opt for the certainty of Absolute Assignment, the flexibility of Collateral Assignment, or the estate planning advantages of an Irrevocable Life Insurance Trust, each method offers a unique pathway to peace of mind. This decision not only streamlines the process of funding your funeral expenses but also stands as a final act of care and consideration for your family, ensuring they can focus on remembering and celebrating your life rather than navigating financial complexities.

No, the beneficiary of a life insurance policy is not automatically responsible for funeral expenses. The responsibility depends on prior arrangements, such as if the policy’s proceeds are designated to cover such costs or if an agreement exists with the estate.

Upon someone’s death, the life insurance policy’s beneficiaries or the executor of the estate should promptly notify the insurance company, provide the required documentation, including the death certificate, and follow the insurer’s process to file a claim for the death benefit.

Transferring the ownership of a life insurance policy to a child involves legally changing the policy owner to the child, which can be done by contacting the insurance company and completing the necessary paperwork. This action may have implications on the policy’s tax status and the control over the policy’s future decisions.

Here is our expert author, Kyle, your go-to source for simplified insights into the world of life insurance. With years of industry experience, Kyle delivers concise and approachable content, ensuring you navigate the complexities with confidence.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2024. All Right Reserved.

Get Free Life Insurance Quotes