SPEAK TO A LICENSED AGENT

SPEAK TO A LICENSED AGENT

When we grow older, it’s important to consider how we can take care of our final expenses in a way that’s easy on our loved ones. This is where funeral cover for pensioners comes in. But what is funeral coverage, and why should pensioners consider it? Insurance helps cover the cost of a funeral, so your family doesn’t have to worry about it.

Finding the right funeral cover can be a relief for those enjoying their retirement years, knowing that everything will be taken care of when the time comes. So, how do you find a funeral cover that fits your needs and budget? Let’s look into this more and see how it can help bring peace of mind during your golden years.

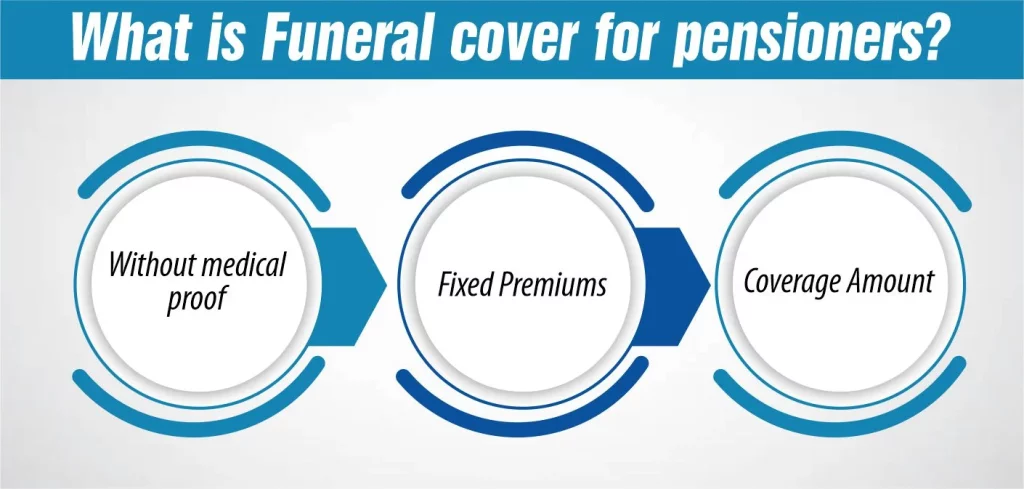

Funeral cover is a type of insurance policy specifically designed to cover the costs associated with a funeral and other final expenses for individuals in their retirement years. This cover aims to ease the financial burden that can fall on family members or loved ones in the event of the policyholder’s death. Key aspects of funeral cover include:

Without medical proof: Most funeral cover policies for pensioners do not require medical examinations, making it easier for older individuals to qualify.

Fixed Premiums: The premiums are generally fixed and do not increase as the policyholder ages, making it easier to budget for them, especially for those on fixed retirement incomes.

Coverage Amount: The cover typically provides a set amount of money that is paid out upon the policyholder’s death to cover funeral expenses such as the coffin, funeral service, burial or cremation costs, and other associated expenses.

The age limit for funeral cover for pensioners can vary depending on the insurance provider and the specific policy. Generally, most funeral cover policies are designed to be accessible to seniors, and there may be higher age limits for joining than other types of insurance. Commonly, you might find:

Maximum Entry Age: what is the age limit on funeral plans for pensioners? Depending on your provider, you will not be able to get cover for yourself or family members over the age of 74, for example. In contrast, the main members most likely cannot buy funeral policies if they are over 64.

Coverage Duration: Once enrolled, coverage usually continues for the rest of the policyholder’s life, provided premiums are paid. There might be no upper age limit for how long the cover is provided.

Age Considerations: It’s important to note that age can affect the cost of the policy. Generally, the older you are when you take out funeral cover, the higher the premiums might be.

Special Senior Policies: Some insurance companies offer funeral cover policies tailored for seniors, which may have different age-related terms and benefits.

It’s advisable to check with individual insurance providers for their specific age limits and terms, as these can vary. Additionally, it’s important to look into the details of what each policy offers and its cost-effectiveness for your age group before deciding.

Funeral cover for pensioners offers several advantages and some potential drawbacks. Understanding these can help in making an informed decision:

Financial Relief for Families: It ensures that the funeral costs won’t burden your family, as the policy covers most expenses.

No Health Checks Required: Typically, there are no medical examinations, or health questions asked when applying for funeral cover, making it accessible for older individuals with health issues.

Guaranteed Acceptance: Most funeral cover policies offer guaranteed acceptance for seniors up to a certain age.

Fixed Premiums: Some policies offer fixed premiums that do not increase as you age.

Immediate Cover for Accidental Death: Many policies provide immediate coverage in case of accidental death.

Flexible Plans: You can often choose a cover level that suits your budget and specific needs for the funeral service.

Ease of Arrangement: Having a plan can make the funeral arrangement process smoother and less stressful for family members.

Lifetime Cost vs. Benefit: Depending on when you take out the policy and how long you live, you may end up paying more in premiums than the value of the cover.

Inflation Impact: Some cheaper policies may not keep pace with inflation, meaning the payout might not cover the entire cost of a future funeral.

Waiting Periods: Many policies have a waiting period (often one or two years) for death due to natural causes, during which a claim cannot be made.

Coverage Limitations: There might be limitations on what the funeral cover includes, with additional costs for certain services or items.

Potential for Overlapping with Existing Plans: If you already have life insurance or other policies, adding funeral cover might be unnecessary.

Cancellation Terms: If you cancel the policy or miss payments, you might lose the coverage and won’t get your premiums back.

In summary, funeral cover for pensioners can provide significant peace of mind and financial protection, but it’s important to consider the costs, terms, and circumstances carefully. Reviewing different policies and consulting with a financial advisor can help in choosing the right cover.

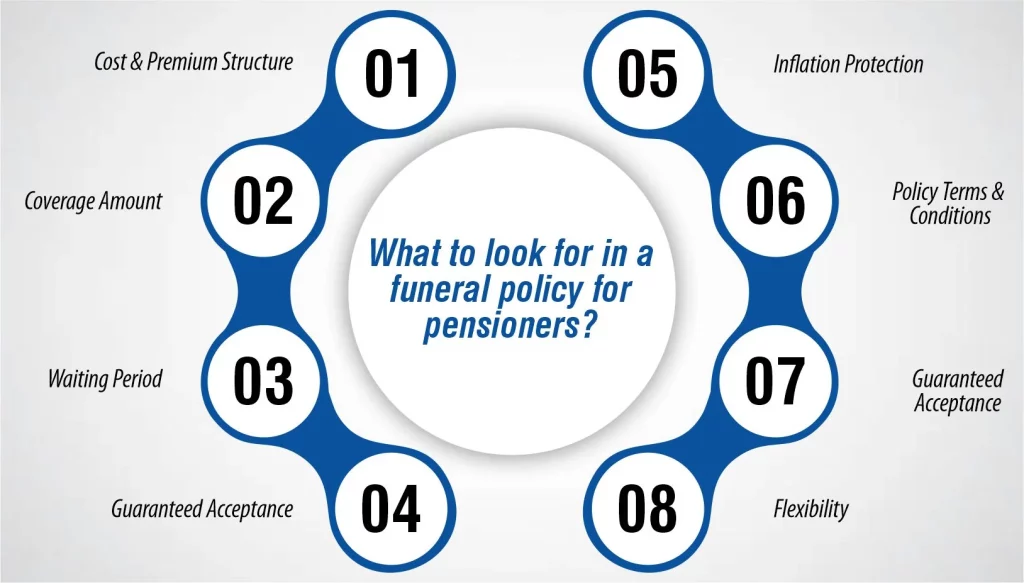

When searching for a funeral policy tailored explicitly for pensioners, several key factors should be considered to ensure that the policy meets your needs and provides the right level of support. Here’s what to look for:

Evaluate the policy’s cost. Please make sure the premiums are affordable and consider whether they are fixed or will increase over time. Understanding whether you can comfortably manage the payments is essential, especially with a fixed retirement income.

Determine how much coverage you need. The policy should cover the cost of the type of funeral you desire, including services, coffin, transportation, burial or cremation, and other related expenses.

Check the waiting period before the policy pays out. Many funeral policies have a waiting period for death due to natural causes, usually ranging from one to two years.

Consider if the policy offers protection against inflation. Some policies increase the cover amount periodically to keep up with rising costs.

Read the fine print carefully. Understand the terms and conditions, including what exactly is covered, any exclusions, and the process for making claims.

The claim process should be straightforward and efficient, as the main aim of funeral cover is to provide quick financial assistance to cover funeral expenses.

Look for flexibility in the policy, like the ability to adjust coverage or add additional family members if needed.

Taking the time to assess these aspects carefully will help ensure that the funeral policy you choose offers peace of mind and meets your needs as a pensioner. Discussing options with a financial advisor or insurance specialist is often beneficial.

Deciding whether funeral cover for pensioners is worth buying involves weighing personal circumstances and financial considerations. For many pensioners, the value lies in the assurance that their funeral expenses will not become a burden to their families. This type of cover often requires no medical exams, making it accessible to most seniors and offering a straightforward way to plan for inevitable costs.

The premiums are typically designed to be affordable on a pensioner’s budget, and the policy can often be tailored to suit individual needs and preferences for funeral arrangements. However, balancing the cost against the potential benefits is crucial, especially if you have existing life insurance or savings that could cover funeral expenses. Funeral cover can be a valuable investment for those seeking peace of mind and a simple solution to manage future expenses. It’s about more than just the financial aspect; it’s about planning with dignity and easing the emotional burden on loved ones during a difficult time.

Funeral cover for pensioners is generally safe and reliable, especially when you choose a policy from a reputable insurance provider. These policies are designed to provide specific benefits, primarily ensuring that funeral expenses are covered without placing a financial burden on your family. However, as with any financial product, there are several factors to consider to ensure its safety and suitability:

Choose a well-established and financially stable insurance company with a good track record. Research their history, customer reviews, and financial ratings.

Understand the policy’s terms, including coverage details, premiums, waiting periods, and exclusions. Ensure that the policy meets your expectations and needs.

Check if relevant financial authorities regulate the insurance provider. This offers assurance that the company adheres to industry standards and practices.

Be aware of potential risks, such as the possibility of the premium costs exceeding the benefit over time or the impact of inflation on the fixed benefit amount.

In conclusion, selecting the right funeral cover for pensioners is crucial in ensuring a dignified farewell without financial stress for loved ones. It’s not just about covering expenses; it’s about peace of mind, knowing that everything is taken care of. With various options available, it’s important to choose a policy that aligns with your needs, offers clear terms, and comes from a reputable provider.

By doing so, pensioners can rest assured that their final arrangements will be handled respectfully, reflecting their wishes and easing the burden on their families. This thoughtful preparation symbolizes care and consideration, leaving a legacy of responsibility and love. As we journey through life, this step ensures that our final chapter is written with the same dignity and grace we strived to live by.

Here is our expert author, Iqra, your go-to source for simplified insights into the world of life insurance. With years of industry experience, Iqra delivers concise and approachable content, ensuring you navigate the complexities with confidence.

Burial Senior Insurance is a website that provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Get Free Life Insurance Quotes

Get Free Life Insurance Quotes

Compare and Secure Your Future With Our Free Life Insurance