Last Updated on: May 14, 2024

Reviewed by Kyle Wilson

Maintaining money as you get older can be compared to organizing a large vacation to a place you’ve never visited. Make sure you have enough cash so you can do all you desire, like take trips, entertainment, or participating in activities of interest, without worrying about running out of money. So, what are a few ways to make sure that Later Life Financial Planning survive as long as you need it to and that you may continue to enjoy yourself as you grow older? This is the main goal of making financial plans for the future. So, what are a few ways to make sure that your finances survive as long as you need it to and that you may continue to enjoy yourself as you grow older? This is the main goal of making financial plans for the future. It’s like putting together a map for a long journey.

You figure out what you’ll need, how to make your savings last, and how to keep some money coming in. It’s not just about keeping your money safe; it’s about planning to enjoy your life later, feeling calm and happy because you know you’ve got everything covered. Let’s dive into how you can make a good Later life financial planning or your money so your older years can be as enjoyable and worry-free as possible.

Customized Options Await

Senior life financial planning involves putting investment strategies in place to make sure you have enough money to support yourself and your chosen lifestyle when you retire. It involves analyzing your current financial situation, making financial goals for the future, and making a plan to manage your income, savings, assets, and spending as you become older.

Planning of this kind addresses several topics, such as:

Retirement Savings: Analysing your living expenses, interests, and other personal objectives to determine how much money you’ll need to save for a Later Life Financial Planning.

Investing strategy: Investing strategy involves selecting appropriate investments to increase savings and control risk, particularly as one approaches retirement age.

Income management: The third step is income management, which involves making plans to maintain a consistent income stream after you quit working or cut back on your hours from investments, pensions, savings, and other sources.

Medical Expenses: Budgeting for medical costs can add up as you age and may include long-term care.

Estate Planning: Choosing beneficiaries for your insurance and accounts, creating trusts, and drafting a will are just a few of the decisions you make regarding how your assets will be divided after your death.

Tax Planning: Knowing how to minimize your taxes in retirement will help you keep more of your income working for you.

Financial preparation is crucial later in life because it directly impacts your retirement quality of life. Your later years can be enjoyed stress-free without worrying about money if you prepare ahead and have enough money saved.

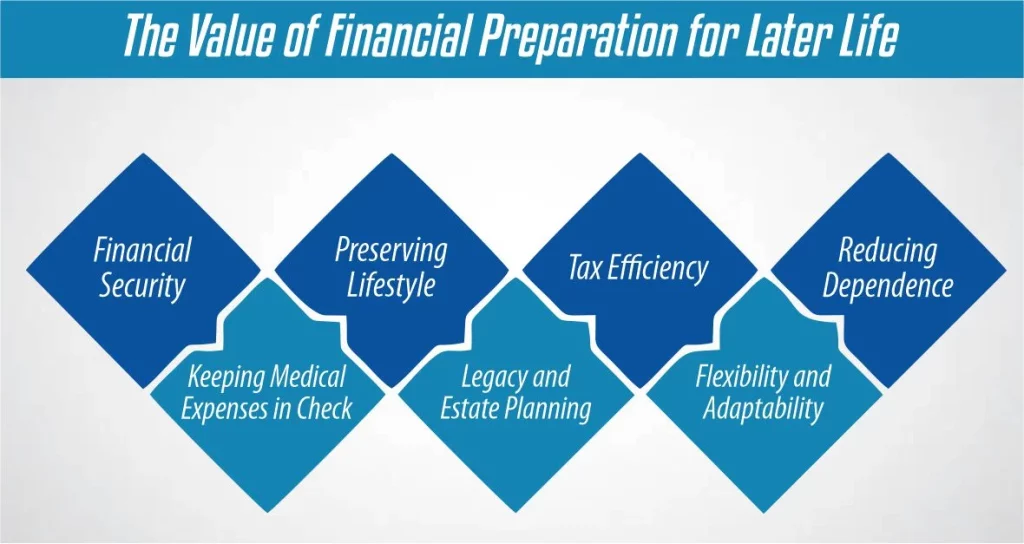

Later life financial planning is crucial for a safe and happy retirement, and its significance cannot be emphasized. It’s important for the following main reasons:

Having adequate assets to cover everyday living expenditures, leisure pursuits, and unforeseen expenses in retirement is a guarantee that comes with careful planning and offers peace of mind.

Healthcare concerns grow in importance as you become older. Making financial plans in advance will help you avoid depleting your resources due to hefty medical bills by helping you pay for medical care, long-term care, and any unforeseen health concerns.

You may preserve, if not raise, your retirement level of living by organizing your funds. It relieves you of paying for your travels, hobbies, and leisure pursuits.

It helps you keep your assets in line with your wishes and care for your loved ones when you pass away. It also allows you to manage your estate efficiently.

Using effective tax planning, you may save money by paying less in taxes on your inheritance, investments, and retirement income.

To maintain your purchasing power and Later Life Financial Plannings, prudent financial planning considers how inflation may affect your income and savings over time.

A carefully considered plan offers a structure that can evolve to accommodate modifications in your financial status, health, or personal objectives.

You can maintain your independence and dignity by not needing family or government support if you have sufficient financial resources.

A sound financial plan for your later years will provide you peace of mind and free up your time to enjoy life instead of stressing about money.

To sum up, Later life financial planning is crucial to safeguarding your future and ensuring you can safely and comfortably enjoy your retirement years. The goal is to make wise choices now and preserve and improve your situation later on.

You must include later-life planning in your overall financial strategy for several reasons. In addition to preparing you for retirement, it ensures you’re ready to deal with the financial fallout from becoming older. Including later-life planning in your financial strategy is important for the following reasons:

By making financial plans for the future, you may estimate how much money you’ll need to sustain your ideal standard of living in retirement, taking into account your living expenditures, recreational interests, and other personal objectives you may have.

Growing older frequently means more frequent medical necessity. By budgeting ahead, you can save your savings from being completely depleted by paying for future medical costs, including possible long-term care.

Due to medical progress, individuals are living longer. Planning for the future reduces the chance that you won’t outlive your retirement assets by ensuring they last the entire lifespan.

It gives you the ability to decide with knowledge how your assets will be divided after your death. Make sure your legacy is passed on how you want it to be by using estate planning instruments like trusts and wills.

Your lifetime income can be maximized by using strategic planning to help you decide when it is best to begin receiving Social Security payments.

By minimizing taxes on retirement income, you can keep more of your hard-earned money with the help of effective later-life planning.

Making plans for your later years helps guarantee that your dependents will be taken care of in your absence, should you have any. You may also want to leave a financial legacy for your loved ones.

Having a retirement and beyond plan can bring you peace of mind by reducing stress and anxiety and letting you enjoy the present with assurance for the future.

Rather than relying on snap judgments to address your housing, finances, and health, later-life planning promotes proactive decision-making.

Unpredictability characterises life. Well-thought-out later-life planning ensures you can adjust as necessary by providing backup plans for unforeseen circumstances like sudden health problems or economic downturns.

It’s not only about protecting your future when you include Later Life Financial Planning into your financial plan; it’s also about building a road map that will provide you and your loved ones peace of mind no matter what the future brings.

As a result, Later life financial planning is a significant step towards enjoying a retirement full of contentment, financial independence, and serenity rather than merely providing for your future. You create a future where ambitions come true and life’s golden years are fully experienced by carefully planning today. It would be best to remember that it’s never too early or too late to start planning for a future that aligns with your values and objectives, regardless of where you are creating your financial piece. Envision a financially gratifying retirement that matches the years you’ve spent working towards it by using the process of later life planning as your guide.

Planning for the economical aspects of your last years and the distribution of your wealth after death is referred to as Later Life Financial Planning. It involves writing a will, establishing trusts, planning for medical expenses, as well as making sure your assets are distributed in accordance with your desires. By carrying out this preparation, you may make sure your affairs are in order and lessen the financial strain on those you cherish.

To plan for later life:

In particular, Orman has sound advice for seeking a good financial planner. It boils down to just 5 words: Someone who doesn’t sell products.

When you begin to generate an income, which is usually in your late teens or early twenties, is the best moment to start saving for your financial future. By starting early, you may take advantage of compound interest in insurance and have more time to form sound financial practices. But there’s never a bad moment to start; getting started at any age may help you reach your financial objectives.

Here is our expert author, Kyle, your go-to source for simplified insights into the world of life insurance. With years of industry experience, Kyle delivers concise and approachable content, ensuring you navigate the complexities with confidence.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2024. All Right Reserved.

Get Free Life Insurance Quotes