SPEAK TO A LICENSED AGENT

SPEAK TO A LICENSED AGENT

Are you or a loved one managing kidney disease and finding yourself worrying about the future, specifically about the costs associated with final expenses? Many face difficulties, and knowing you’re not alone in this journey is important. Burial insurance, a type of life insurance, is designed to offer peace of mind during these challenging times.

This specialized burial insurance kidney disease plan helps cover the expenses of final arrangements, ensuring that your family doesn’t have to bear the financial burden during an already difficult period. But how does it work, especially for those with kidney disease? Let’s discuss the details and explore burial insurance, kidney disease, and how burial insurance can provide a safety net, ensuring that you and your loved ones can focus on what truly matters – cherishing every moment together.

Burial insurance kidney disease for individuals is a specific type of life insurance policy designed to cover the final expenses of someone diagnosed with kidney disease. This form of burial insurance kidney disease is especially crucial for those with this condition, as it provides financial security and eases the burden on families during loss.

Kidney disease can often lead to increased medical expenses and, in some cases, may shorten a person’s lifespan, making it challenging to secure traditional life insurance policies. Burial insurance policies are structured to offer a solution to this problem. They typically do not require a medical exam, and the application process involves answering a few health-related questions. This accessibility makes burial insurance an attractive option for those with chronic conditions like kidney disease.

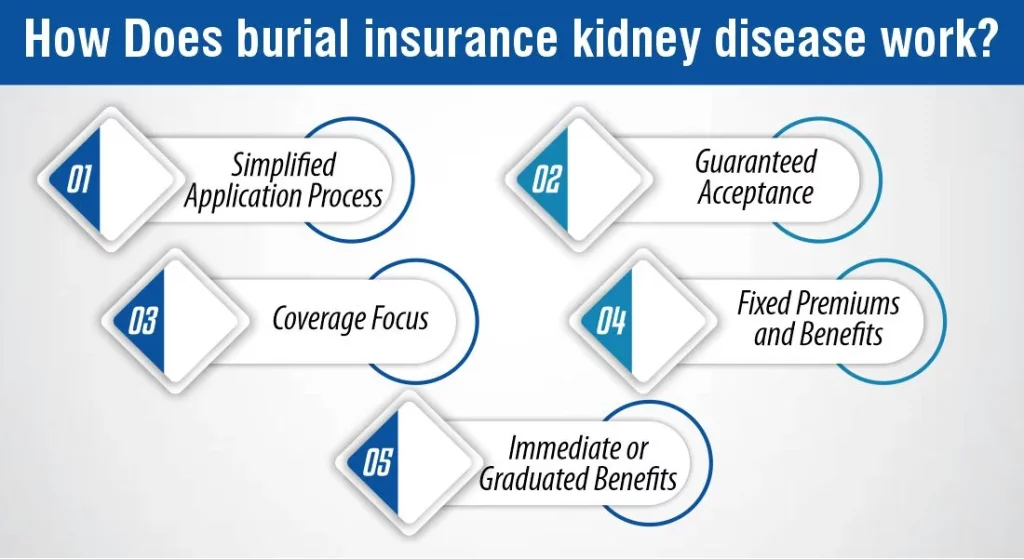

Burial insurance for individuals with kidney disease is a type of life insurance designed to specifically address the financial needs related to final expenses for those diagnosed with this condition. Understanding how it works can provide peace of mind to those affected and their families, ensuring their focus remains on health and well-being rather than financial concerns during difficult times. Here’s an outline of how burial insurance for kidney disease operates:

One key feature of burial insurance for people with kidney disease is its simplified application process. Unlike traditional life insurance policies that require comprehensive medical exams and extensive health questionnaires, burial insurance often minimizes these requirements. Many policies do not necessitate a medical exam and may only ask a few health-related questions, if any. This approach makes it easier for individuals with pre-existing conditions, like kidney disease, to qualify for coverage.

Many burial insurance policies offer guaranteed acceptance, which means individuals with kidney disease can obtain coverage without the fear of being denied due to their health condition. This aspect is essential for those who have difficulty securing traditional life insurance because of their diagnosis.

The coverage provided by burial insurance kidney disease is specifically intended to cover the costs associated with end-of-life expenses. This can include funeral costs, burial or cremation expenses, and potentially outstanding medical bills or debts. The policy is designed to alleviate the financial burden on families during mourning, ensuring they do not have to worry about the financial aspects of laying their loved ones to rest.

Burial insurance policies typically come with fixed premiums, meaning the amount you pay monthly remains constant over the policy’s life. The death benefit (the amount paid out upon the policyholder’s death) is also fixed. This predictability is crucial for individuals with kidney disease and their families, as it provides a clear understanding of the financial relief provided by the policy.

Depending on the policy and the insurer, some burial insurance policies may offer immediate benefits, while others might have a waiting period (often called graded benefits). Quick benefit policies provide the full death benefit from the policy’s inception. In contrast, graded benefit policies might only pay out a portion of the death benefit if the policyholder dies within the first few years of the policy. Understanding these details is important when choosing a policy to ensure it meets the policyholder’s needs and expectations.

There are prices for plans with and without health questions.

Remember that these are estimates. Your price will be determined by your age, gender, overall health history, state, tobacco usage (if any), and how much coverage you want.

| Age & Gender | $10,000 Simplified Issue (Monthly Rates) | $10,000 Guaranteed Acceptance (Monthly Rates) |

| Female age 40 | $12 | $21 |

| Female age 45 | $13 | $23 |

| Female age 50 | $14 | $24 |

| Female age 55 | $15 | $28 |

| Female age 60 | $18 | $33 |

| Female age 65 | $22 | $41 |

| Female age 70 | $28 | $53 |

| Female age 75 | $37 | $71 |

| Female age 80 | $50 | $98 |

| Female age 85 | $70 | $136 |

| Female age 89 | $131 | N/A |

| Male age 40 | $14 | $25 |

| Male age 45 | $15 | $27 |

| Male age 50 | $17 | $31 |

| Male age 55 | $20 | $36 |

| Male age 60 | $23 | $43 |

| Male age 65 | $29 | $54 |

| Male age 70 | $37 | $70 |

| Male age 75 | $50 | $97 |

| Male age 80 | $69 | $135 |

| Male age 85 | $91 | $178 |

| Male age 89 | $180 | N/A |

Kidney disease affects life insurance rates primarily because it is often associated with increased health risks and a higher likelihood of serious complications, which can shorten life expectancy. Life insurance companies consider these factors:

Increased Health Risks: Kidney disease can lead to significant health complications, including cardiovascular disease, anemia, bone disease, and high blood pressure. These complications can increase mortality risk, a primary concern for insurers.

Progressive Nature of the Condition: Chronic kidney disease (CKD) often progresses over time, potentially leading to end-stage renal disease (ESRD) and the need for dialysis or a kidney transplant. This progression poses a higher risk for insurers.

Combined with Other Conditions: Kidney disease is often associated with other severe health conditions like diabetes and hypertension. Multiple health issues can compound the risks, leading to higher premiums.

Treatment and Management Complexity: The management of kidney disease can be complex and costly. Regular monitoring, medication, and possibly dialysis or transplant increase the insured’s health risks and potential claim costs.

Life Expectancy Impact: Insurers rely on actuarial data and medical research that often shows a decrease in life expectancy for individuals with severe health conditions like kidney disease. This statistical risk is factored into the insurance rates.

Due to these factors, life insurance companies may consider individuals with kidney disease at higher risk, typically reflected in higher premiums. In some cases, individuals with advanced kidney disease may face difficulties obtaining standard life insurance and might need to look into specialized or guaranteed-issue life insurance plans.

When burial insurance companies evaluate applicants with kidney disease, their approach is generally more lenient than traditional life insurance providers. Burial insurance, also known as final expense insurance, typically requires no medical exam and has less stringent underwriting processes. However, certain aspects of kidney disease are still taken into consideration:

The stage of your kidney disease plays a significant role. Early stages are usually less concerning than more advanced stages like chronic kidney disease (CKD) or end-stage renal disease (ESRD). Companies offer different policy types depending on the severity.

While the focus is on kidney disease, your overall health is still important. Coexisting conditions, especially those commonly associated with kidney disease (like diabetes or hypertension), can influence the assessment.

Managing your kidney disease, including adherence to any treatment plans or medications, can impact the evaluation. Stable conditions with effective management are viewed more favorably.

Age and Lifestyle: As with most insurance policies, age is a factor. Younger applicants with kidney disease might find it easier to obtain burial insurance. Lifestyle choices, such as smoking and alcohol use, also play a role in the evaluation process.

Policy Types and Coverage Limits: Burial insurance policies generally have lower coverage limits than standard life insurance, as they are intended to cover only funeral expenses and possibly some outstanding debts. Applicants with kidney disease might have access to different types of policies, such as those with graded benefits, where the full benefit amount is only available after holding the policy for a specific period.

Simplified vs. Guaranteed Issue Policies: Simplified issue policies may ask a few health questions but don’t require a medical exam. Applicants with less severe kidney disease might qualify for these. For more advanced cases, guaranteed issue policies, which require no health questions, might be the only option, though they often come with higher premiums and graded benefits.

Burial insurance companies understand that applicants looking for this type of insurance might have existing health issues. Therefore, they are generally more accommodating, but the extent of kidney disease and related factors will still influence policy availability and pricing. As always, comparing offers from multiple companies is advisable to find the most suitable coverage.

In conclusion, securing burial insurance kidney disease is a reassuring and proactive step toward ensuring peace of mind for you and your loved ones. While kidney disease can be a significant factor in the evaluation process, the more accommodating nature of burial insurance policies offers a viable solution for many. With options ranging from simplified issues to guaranteed issue policies, there’s a pathway to obtain the necessary coverage, regardless of the stage of your condition. By taking this thoughtful action, you can alleviate the financial burden of end-of-life expenses from your family, allowing them to focus on what truly matters – cherishing your memory and celebrating your life.

Yes, kidney disease is usually covered under critical illness insurance, but it’s essential to verify the details in your specific policy.

Insurance coverage for kidney disease varies by policy. Most health insurance plans cover kidney disease treatment, but reviewing your policy or checking with your insurance provider for detailed information is important.

Yes, you can obtain life insurance with kidney disease, but it may impact your policy terms and premiums. Insurers will consider the severity and management of your condition when determining coverage eligibility and costs.

Here is our expert author, Iqra, your go-to source for simplified insights into the world of life insurance. With years of industry experience, Iqra delivers concise and approachable content, ensuring you navigate the complexities with confidence.

Burial Senior Insurance is a website that provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Get Free Life Insurance Quotes

Get Free Life Insurance Quotes

Compare and Secure Your Future With Our Free Life Insurance