Last Updated on: April 04, 2025

Reviewed by Kyle Wilson

Imagine securing a safety net for your loved ones, ensuring they’re shielded from the burdens of end-of-life expenses. For years, MetLife stood as a beacon of assurance, offering various insurance solutions. However, a recent shift has left many wondering about one crucial aspect: burial insurance.

MetLife, a name synonymous with reliability in the insurance realm, has altered its offerings, notably departing from the final expense insurance landscape. The absence of burial insurance from their repertoire has prompted individuals to seek clarity regarding their current offerings and alternatives.

In this journey of financial planning and safeguarding our future, understanding the transformations within MetLife’s suite of services becomes pivotal. Let’s navigate through these changes, explore available alternatives, and ensure we’re equipped with the right tools to secure peace of mind for ourselves and our families.

Get Free Quotes

Customized Options Await

As of the latest available information, MetLife does not offer burial insurance or final expense insurance. The company has shifted its focus away from providing specific burial insurance policies and instead emphasizes various other life insurance products, including term life, group variable universal life, group universal life, and accidental death coverage. Burial life insurance is notably absent from their current product lineup.

MetLife’s decision to exit the final expense insurance market occurred sometime after 2014. Additionally, following a restructuring in 2017, MetLife separated its U.S. retail business, launching Brighthouse Financial as an independent entity. However, neither MetLife nor its spinoff, Brighthouse Financial, presently offers final expense life insurance tailored for seniors or burial insurance policies.

Therefore, if individuals are specifically seeking burial insurance coverage, it’s advisable to explore alternative insurance providers specializing in final expense insurance to secure adequate protection for end-of-life expenses.

MetLife, a renowned and respected name in the insurance industry, has a legacy built upon reliability and a commitment to safeguarding families’ financial futures. For years, MetLife stood as a prominent provider, offering various insurance solutions tailored to meet diverse needs. Among these offerings was their burial insurance, also known as final expense insurance.

MetLife’s burial insurance policies were designed to provide peace of mind to policyholders and their families, ensuring that end-of-life expenses, including funeral costs and related expenditures, were covered. The company’s reputation for exceptional customer service and comprehensive coverage plans contributed to its legacy in the realm of final expense insurance.

However, with the evolving landscape of insurance products and services, MetLife has undergone changes in its offerings. At present, the company has shifted its focus away from providing burial insurance, directing its attention to other life insurance products, such as term life, group variable universal life, group universal life, and accidental death coverage.

While the specific details of MetLife’s burial insurance plans might not be available anymore, the company’s legacy of prioritizing financial security and support for families during challenging times remains a core part of its ethos.

MetLife, recognized as a comprehensive insurance provider, offers a diverse range of insurance products to cater to various needs. Despite the absence of burial insurance in their current lineup, the company continues to provide an array of valuable insurance solutions, including:

Offering coverage for a specific period, typically ranging from 10 to 30 years, term life insurance provides financial protection for beneficiaries if the insured passes away during the policy term.

This type of life insurance combines the flexibility of universal life insurance with investment options, allowing policyholders to allocate premiums into various investment accounts.

Similar to GVUL, GUL offers flexibility in premium payments and accumulates cash value over time, providing death benefit protection along with potential cash value growth.

This coverage pays out a benefit in case of accidental death, providing an additional layer of financial protection for unforeseen accidents.

MetLife’s commitment to offering a diverse portfolio of insurance products ensures that individuals and families can find tailored solutions to meet their specific needs. While burial insurance may no longer be part of their offerings, the company’s dedication to providing comprehensive coverage for various life stages remains a key aspect of its services.

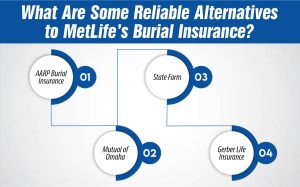

When considering alternatives to MetLife for burial insurance or final expense coverage, several reputable insurance providers specialize in offering tailored solutions for end-of-life expenses. Some reliable alternatives include:

AARP offers burial insurance plans through its collaboration with New York Life Insurance Company. These plans are specifically tailored for seniors aged 50-80, providing coverage amounts ranging from $2,500 to $25,000.

AARP burial insurance typically guarantees acceptance without the need for a medical exam. The coverage helps beneficiaries cover funeral expenses, outstanding debts, and other end-of-life costs. AARP’s reputation for advocacy for older adults adds credibility to its insurance offerings, providing peace of mind to policyholders and their families.

Mutual of Omaha is a well-established insurance company known for its reliable final expense insurance plans. Their burial insurance policies offer coverage from $2,000 to $25,000, providing options for individuals to select coverage that suits their needs.

Mutual of Omaha’s policies typically come with fixed premiums and guaranteed acceptance for individuals within certain age brackets, usually between 45 to 85 years old. The company’s long-standing reputation for stability and excellent customer service further enhances its appeal to those seeking final expense coverage.

State Farm, a widely recognized insurance provider, offers final expense insurance options with coverage typically ranging from $10,000 to $100,000. Their burial insurance plans often allow policyholders to customize coverage based on their individual needs.

State Farm’s personalized service, financial strength, and the ability to bundle policies with other insurance products make it an appealing choice for individuals seeking comprehensive final expense coverage.

Gerber Life specializes in providing affordable final expense insurance, offering coverage amounts ranging from $5,000 to $25,000. Their burial insurance plans cater to seniors aged 50-80, featuring simplified underwriting and guaranteed acceptance without a medical exam.

Gerber Life’s focus on simplicity, reliability, and providing coverage specifically tailored for seniors has made it a trusted choice among individuals looking for straightforward final expense coverage.

These insurance providers stand out in the final expense insurance market, each offering unique features, coverage options, and customer service strengths. Understanding the specifics of each company’s offerings can assist individuals in making informed decisions based on their preferences and requirements when planning for their end-of-life expenses.

When considering final expense insurance, it’s essential to weigh your options carefully. While MetLife no longer offers burial insurance, these alternative providers excel in offering comprehensive coverage and reliable customer service, ensuring individuals can secure financial protection for their loved ones’ future expenses. Evaluating the specific features, coverage options, and reputation of these companies can help individuals make informed decisions when selecting the right final expense insurance to meet their unique needs and preferences.

No, existing MetLife burial insurance policyholders are unaffected by the company's transition. Their policies remain valid, and coverage terms and benefits remain unchanged.

MetLife might offer options for policyholders to convert their existing burial insurance policies to different types of life insurance within the company's portfolio. Contacting a MetLife representative directly is recommended for specific details.

Yes, some alternative providers offer added benefits like accelerated death benefits, allowing policyholders to access a portion of their death benefit if diagnosed with a terminal illness, providing financial support during difficult times.

Alternative providers often offer guaranteed acceptance policies for certain age groups, eliminating the need for medical exams. However, eligibility criteria might vary based on age, health status, and coverage amount desired.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes