Last Updated on: March 19th, 2025

Reviewed by Kyle Wilson

Planning for the future often involves making crucial decisions about your financial security and peace of mind. Have you considered the benefits of burial insurance in Texas?

Texas burial insurance (also known as final expense life insurance or funeral insurance) is a type of whole-life policy that protects your family from common end-of-life expenses like funeral costs, medical bills, and anything else left behind by the deceased. A funeral insurance policy in the state of Texas can also help family members pay down mortgages, make car payments, and cover any other expected debt.

Buying burial insurance for seniors in Texas isn’t that different from buying life insurance in other states, but there is some important information specific to Texas that you’ll need to know. We’ll go over this and more and show you more details about it.

Customized Options Await

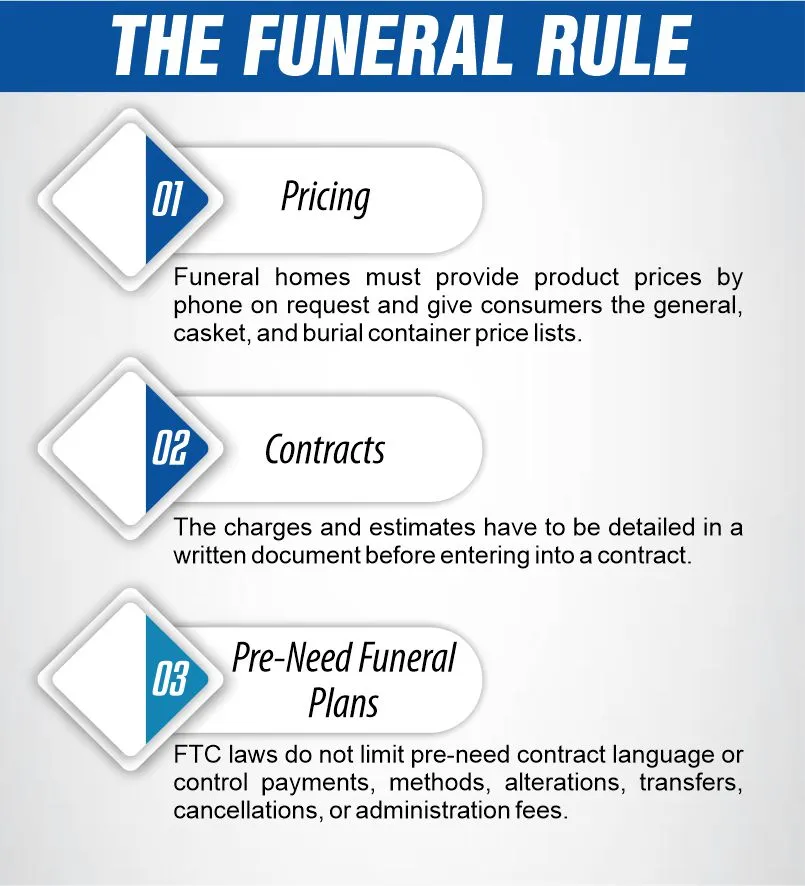

According to Federal law, certain fundamental laws are associated with Burial Insurance in Texas. These rules are referred to as the Funeral Rule and apply to each state, having been imposed by the Federal Trade Commission (FTC).

Pricing – Funeral homes must state the prices of the products and services offered over the phone when requested. On the individual level, consumers are allowed access to the general price list, a casket price list, and a burial container price list in case of cremation.

Contracts – The charges and estimates have to be detailed in a written document before entering into a contract.

Pre-Need Funeral Plans – FTC laws have no limitations to the language of pre-need contracts. They also have little control over payments, payment methods, payment alterations, payment transfers, cancellations, or administration fees.

Every year, the National Funeral Directors Association (NFDA) coordinates and conducts a general price list study that aims to compare the alterations in expenses of funeral and Burial Insurance in Texas. We cannot directly survey states, so states are divided into districts and the NFDA mails a survey to over 5,000 NFDA-member funeral home owners.

The West South Central is the region that includes the states of Arkansas, Louisiana, Oklahoma, and Texas. Regarding the average funeral cost inclusive of burial in this district, the survey indicated that it cost an average of $7,196. Median costs included the following items:

In Texas, a death certificate must be filed with the local registrar within 10 days of death and is usually obtained by the funeral home or mortuary. Texas law states that if the death occurred in the past 25 years, a death certificate can only be requested by an immediate family member. In some cases, individuals who are not immediate family members may apply for a death certificate, such as a beneficiary on a life insurance policy. Anyone who is not an immediate family member must provide documentation showing they have a legitimate interest in the death certificate to apply.

Texas law dictates that if the final disposition of the body does not take place in 24 hours, the body must be embalmed or refrigerated. You do not need a casket to bury a body but it is wise to consult with your funeral director to discover whether he has restrictions on the type and size of the receptacle he accepts from the cemetery.

As per the Texas Health & Safety Code, ashes can be spread on “uninhabited public areas, over public water bodies or sea or any private property with the consent of the owner.” If the intention is to spread the ashes in the water, special care should be taken, as there are certain laws of the Clean Water Act. Find out more about cremations.

The NFDA also found that the average funeral cost in Texas is $7,334 for burial and $6,405 for cremation. All of those figures include a service.

Service Type | Average Cost |

Burial Service | $7,334 |

Direct Burial (No Service) | $3,988 |

Cremation Service | $6,405 |

Direct Cremation (No Service) | $2,108 |

It’s important to remember that the exact cost of a cremation or Burial Insurance in Texas varies based on your preferences.

For example, your burial services will cost less if you opt not to have a viewing.

Using a funeral cost calculator can help you better estimate the cost of a funeral according to your needs.

As for the Texas policies, they range from $50-$100 per month for $10,000 whole-life final expense insurance.

The final cost of Burial Insurance in Texas will depend on your age, gender, health condition, tobacco use (if any), and the face amount you choose to buy.

Here is a rate table with some of the figures to give you an idea of what you could expect to pay or if you are in Texas, you can enter your zip code here and get an exact quote.

Age & Gender | $5,000 | $10,000 |

Female age 40 | $12 | $21 |

Female age 45 | $13 | $23 |

Female age 50 | $14 | $24 |

Female age 55 | $15 | $28 |

Female age 60 | $18 | $33 |

Female age 65 | $22 | $41 |

Female age 70 | $28 | $53 |

Female age 75 | $37 | $71 |

Female age 80 | $50 | $98 |

Female age 85 | $70 | $136 |

Female age 89 | $131 | N/A |

Male age 40 | $14 | $25 |

Male age 45 | $15 | $27 |

Male age 50 | $17 | $31 |

Male age 55 | $20 | $36 |

Male age 60 | $23 | $43 |

Male age 65 | $29 | $54 |

Male age 70 | $37 | $70 |

Male age 75 | $50 | $97 |

Male age 80 | $69 | $135 |

Male age 85 | $91 | $178 |

Male age 89 | $180 | N/A |

The free look period is another insurance law that provides the policyholder with the right to reject the contract offered for any reason.

Also, they are allowed to get back the premium amount so far they have not canceled the policy before the free look period.

The free look period in Texas is between 10-20 days.

That insurance provision means you will have the chance to discuss with the insurer whether you need a change in your policy in any form or not. Moreover, it shields you against some lecherous agents who are out to rob you or swindle you in one way or the other.

One more rule to be aware of is the Federal Trade Commission’s Funeral Rule. To summarize, this law requires funeral establishments to disclose price information in writing where requested. However, there is freedom in choosing what kind of good or service is required in a funeral.

Depending on your current or past health, you may not be comfortable taking a medical exam to qualify for life insurance. Many companies offer a guaranteed product that doesn’t require a medical exam and doesn’t ask any health questions. But these plans are usually the most expensive life insurance plans on the market because the insurance company is assuming the risk of covering someone without knowing how sick they may be.

At other insurance companies, we offer standard final expense life insurance without a medical exam. To qualify for this type of insurance, applicants answer health questions on the application. These plans are usually cheaper than guaranteed plans because the insurance company assumes less risk.

Are you ready to secure your family’s future with a reliable burial insurance plan? At burial senior insurance, we understand the importance of this decision and are here to guide you every step of the way. Contact us today to learn more about our comprehensive Burial Insurance in Texas and how they can provide peace of mind for you and your loved ones. Why wait to plan for tomorrow when you can ensure financial stability today?

While Texas law says that the decedent’s estate is liable to pay for most of the decedent’s funeral costs, the funeral home or provider may include language in their contract to make the surviving spouse or other party personally liable for these costs.

There are no state laws in Texas prohibiting home burial, but local governments may have rules governing private burials.

Unlike traditional term, whole-life, and universal life policies, burial insurance is specifically designed to cover one-time and short-term expenses. It isn’t meant to replace income or cover large expenses like purchasing a home or paying for college. It isn’t a type of retirement plan or investment either.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes